Finance

Fast Payday Loans Review – The Best Payday Loan in UK

Published

2 years agoon

By

Robert King

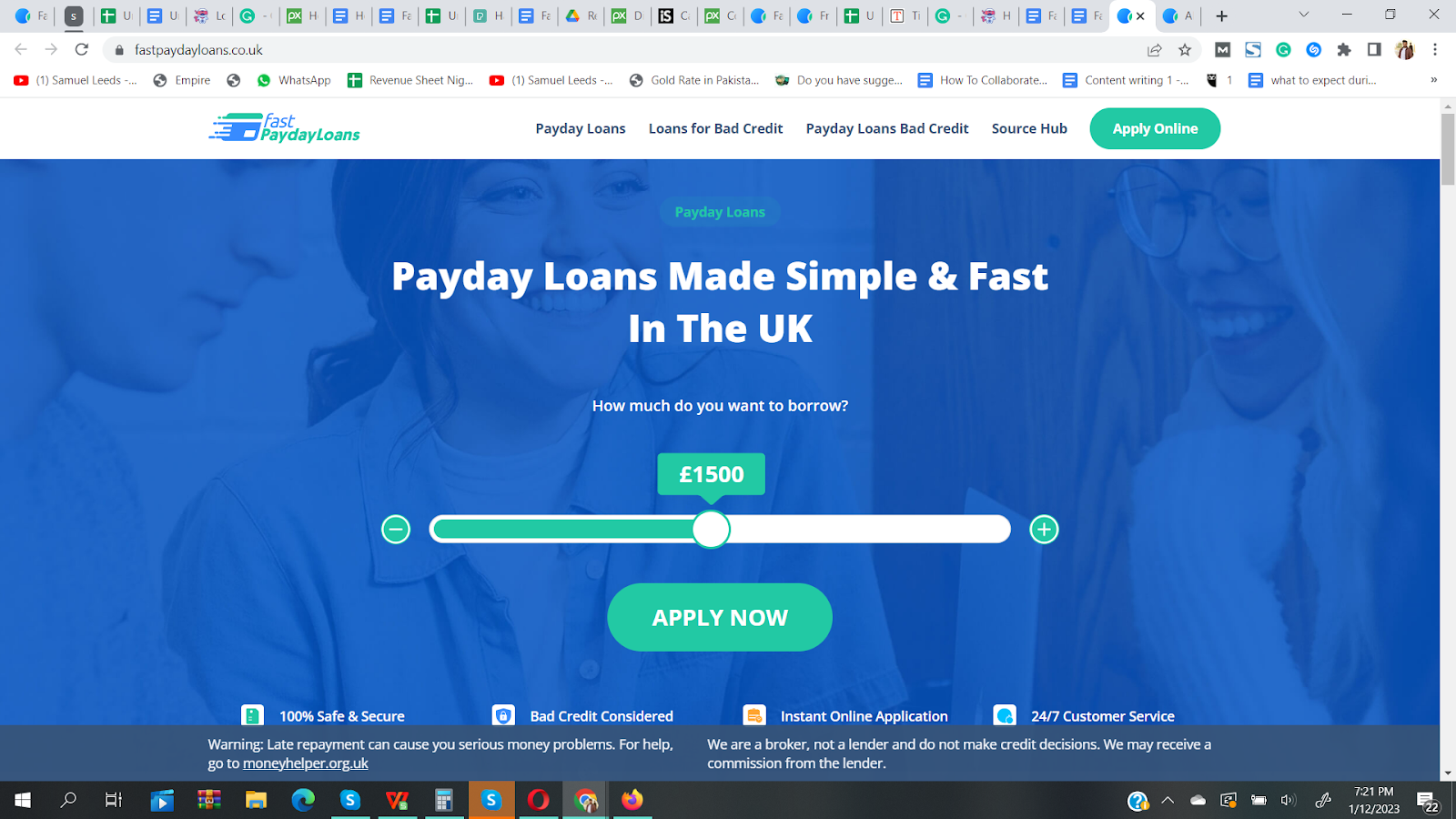

FastPaydayLoans.co.uk is an online loan broker that provides a referral service through its online platform. Their goal is to provide superior customer service that helps customers get the money they need quickly without going through lengthy processes or waiting periods.

Fast Payday Loans Overview

Fastaydayloans.co.uk offers simple and fast payday loan services that provide borrowers with immediate access to payday loans without involving any complicated paperwork or time-consuming procedures allowing them to cover their unexpected expenses and other urgent costs until their next payday arrives.

The application process for the Fast Payday Loans takes just minutes, and customers can receive their payday loans within 24 hours of approval.

The first step in applying for a payday loan is finding the right lender on Fast Payday Loans. Finding the right lender can be difficult, but with a few simple steps, you can find the best option for your needs. They have several reputable lenders in their network ready to help you find a suitable offer in one place. Their team understands that your time is valuable, so they ensure you connect with the right lender quickly and easily.

Choose how much money you need to apply for and then fill out the application form on the Fast Payday Loans website, allowing you to submit your information quickly and conveniently. All the data is securely encrypted, so your personal information remains safe throughout the process. In only a few minutes, you can have your application processed and receive an answer as soon as possible.

All of your information is used to match you with potential lenders who can offer you a payday loan that meets your needs and budget. Once checked, you’ll receive multiple payday loan options in minutes. You have a choice of accepting or simply declining offers.

Once you accept the offer, you will sign an agreement with the lender and your payday loan will be transferred into your account within 24 hours or less. This means you have access to a payday loan when you need it most without waiting for days or weeks for approval.

Fast Payday Loans Pros and Cons

Pros of Fast Payday Loans

- The biggest pro of Fast Payday Loans is their simple application process. It typically only takes minutes for applicants to complete the application, which can be done online.

- It’s safe and secure since the entire process is done online. You don’t have to worry about giving out your personal information. You can be sure that your data is safe.

- There are no hidden fees or charges associated with the payday loan. All of their fees and terms are discussed with each customer before taking out a payday loan.

- Fast Payday Loans don’t conduct traditional credit checks, which means bad credit is not an issue when applying for one of these loans on its website.

- Fast Payday Loans provide customers with 24-hour customer service support. Customers can access help whenever they need it.

- Fast Payday Loans services guarantee that you will have your loan approved as soon as possible and transferred into your account, no matter your financial situation.

Cons of Fast Payday Loans

- Payday loans can come with high-interest rates, short payment periods, and other costly fees that can quickly add up.

- If borrowers cannot make timely payments, they may face serious financial consequences.

Fast Payday Loans Requirements and Application Info

The Fast Payday Loans application process is essential in obtaining a payday loan. Submitting a complete and accurate biodata application can make all the difference in whether or not an applicant receives a payday loan. When submitting a payday loan application, it’s essential to provide the required information as accurately and thoroughly as possible.

It’s vital to ensure that all information provided on the biodata form is correct, including name, address, phone number, income source, and other relevant financial information. They may also need proof of employment or income from self-employment activities.

It’s essential to understand lenders’ eligibility criteria to decide whether or not to approve your application. Below are a few of the most common eligibility criteria you should check before applying for a loan.

- To make sure that you’re eligible to take out a payday loan, they’ll want to know your income level, both current and expected future earnings, so they can calculate what size payday loan would be appropriate for you.

- They will see if you’re a permanent resident in the UK, which will assure them that you’ll be able to pay back the payday loans taken.

- They require applicants to maintain a UK bank account to receive and make payments.

- They will require that your phone number is active, same goes for your email address: it must be current, active, and regularly checked so they can contact you with updates on your payday loan application status.

Fast Payday Loans FAQs

How do I apply for a Fast Payday Loan?

Applying for a payday loan is easy — complete the online application form. You’ll need proof of identity, income, and bank account information. After submitting your application, the lender will review it and decide whether you’re approved.

How do I repay my loan?

The repayment terms depend on the payday loan provider, but most lenders require repayment within two weeks or less. Depending on your arrangement with your lender, you may be able to set up automatic payments from your bank account during the loan period so that repayment occurs automatically when due.

Can I get a payday loan if I have bad credit?

Yes, you may still qualify for a fast payday loan even with poor credit, unlike traditional lenders that consider your credit score when making lending decisions.

Recent News

Instagram Story Viewer: Shaping Social Media!

Could you think of Instagram without stories? Even though Instagram Stories were introduced not so long ago, in 2016, they...

Top Benefits of Using a Phone Appending Platform for Batch Data Updates

In the world of data-driven marketing, having access to accurate and current contact information is essential for successful customer outreach....

3 Tips for Dressing Perfectly for Special Occasions

Dressing for special occasions can sometimes be a stressful and overwhelming process, especially for women. Whether you’re attending a wedding,...

Maximise Your Hunting Success with Dive Bomb Industries Decoys

When it comes to hunting, there’s no such thing as too much preparation. Hunters understand that the right equipment can...

Castle App Free Download — Updated 2024 Version

What is Castle App? Castle App, a stream app developed for streaming media content, makes entertainment effortless by giving clients...

How to get a duplicate RC book for your vehicle: A step-by-step guide

If you have lost or damaged your vehicle’s registration certificate, you must be tense and under stress. But getting a...

Enhancing Property Value Through Professional Builders Cleaning Services in the UK

Construction and renovation projects make a ton of residue, garbage, and soil, passing on a requirement for proficient cleaning to...

Saturn in Sidereal Pisces-March 28,2024 to February 21st 2028 by Jade Luna

I really wanted a female president governing this cycle but the chart of America would choose the hardest path, not...

Top 5 Super Clone Rolex for Women

Super clone Rolex watches are incredibly detailed knock-offs of popular Rolex models, crafted to look and feel just like the...

Transforming Dreams into Reality: A Success Story of Purchase Amazon Seller Account

Purchase Amazon Seller Account: In the fast-paced world of e-commerce, many aspiring entrepreneurs dream of starting their own business. However,...