Three American economists have won the 2022 Nobel Prize in Economics. They are Ben Bernanke – former head of the American central bank, the Federal Reserve (Fed) – Douglas W. Diamond and Philip H. Dybvig.

The Swedish Academy motivated the awarding of this prestigious honor to the three researchers by emphasizing how their work on banks and financial crises was “fundamental for further research. This has improved our understanding of banks, banking regulations, banking crises and how financial crises should be handled. Of the three Nobel Prize winners, the best known to the general public is undoubtedly Ben Bernanke, 69, from 2006 to 2014 Chairman of the Federal Reserve.

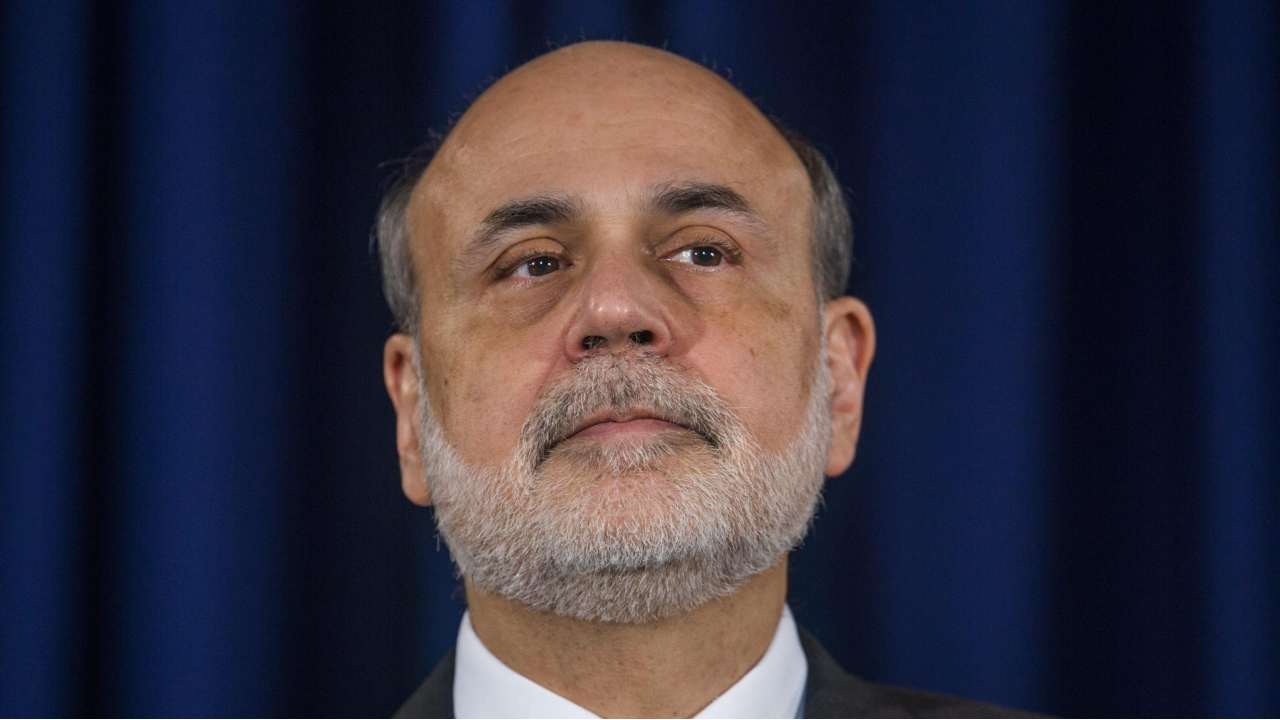

Ben Bernanke. Photo Ansa / Epa Jim Lo Scalzo

Ben Bernanke. Photo Ansa / Epa Jim Lo Scalzo

Bernanke is the man who, as governor of the US central bank, found himself managing the most massive financial crisis of the 21st century. That is to say, that of subprime mortgage loans on houses. A bubble burst in 2007, the consequences of which spread around the world. The then head of the Federal Reserve intervened first by bringing interest rates to zero to stimulate the real economy, then by drawing public attention to a term that had become familiar to many, that of “quantitative easing”: quantitative easing. Bernanke launched an ultra-expansionary monetary policy to inject liquidity into the system to trigger the recovery in consumption. Measures which earned him him to be appointed by George W. Bush, a second term of Barack Obama. And this even if his detractors reproached the new Nobel Prize for not having predicted the dynamics which led to the explosion of the crisis. And also for reacting too slowly in its initial phase.

Douglas Diamond. Photo Ansa / Epa University of Chicago

Douglas Diamond. Photo Ansa / Epa University of Chicago

Nobel Prize for studies on the crisis of 1929

In fact, Ben Bernanke won the 2022 Nobel Peace Prize for his studies of another devastating economic crisis, the one known as the Great Depression, triggered by “Black Tuesday”, i.e. the stock market crash. fellow of October 1929. Bernanke’s studies, according to the Swedish Academy jurors, showed “how bank runs were a determining factor in the deep and prolonged development of the crisis”. Douglas W. Diamond, also 69, a lecturer at the University of Chicago, was honored “for showing how banks play an important role in society.” As intermediaries between savers and borrowers, the jurors point out in their reasons, Diamond’s studies have shown that “banks are the most appropriate institutions to assess the creditworthiness of borrowers, as well as to ensure that loans are used for good investments”.

Philippe Dybvig. Photo Ansa / Epa Washington University, St. Louis, Missouri (USA)

Philippe Dybvig. Photo Ansa / Epa Washington University, St. Louis, Missouri (USA)

Together with Philip H. Dybvig, 67, a lecturer at Washington University in St. Louis, the third to be awarded by the Swedish Academy, the new Nobel Diamond Prize also developed a series of theoretical models at the mid-1980s. They “explain why banks exist, how their role in society makes them vulnerable to rumors of their impending collapse, and how society can reduce this vulnerability”. This is the famous Diamond-Dybvig model. The Nobel Prize provides for a cash prize of nearly $900,000. The handover ceremony will take place in exactly two months, on December 10. Unlike the other prizes, the economics prize does not stem from Alfred Nobel’s will of 1895, but from the Swedish central bank, which instituted it in his memory.