Crypto

Top Crypto Liquidity Providers: Empowering Digital Asset Trading

Published

1 year agoon

Introduction: In the rapidly evolving world of digital assets, liquidity plays a pivotal role in ensuring efficient and seamless trading experiences. Liquidity providers, especially in the crypto market, have emerged as key facilitators, empowering traders with access to deep pools of liquidity. This article will explore the top crypto liquidity providers and how they empower digital asset trading. Additionally, we’ll discuss the relevance of liquidity providers in creating forex brokerage platforms.

Understanding Liquidity Providers

1. What are Liquidity Providers?

Liquidity providers are entities or individuals that offer liquidity by connecting buyers and sellers in financial markets. They act as intermediaries, facilitating trades and ensuring that there is sufficient liquidity available for market participants.

2. Importance of Liquidity Providers in Crypto Trading

In the world of cryptocurrencies, liquidity providers play a critical role in maintaining market efficiency, reducing slippage, and enabling seamless trading experiences. They enhance liquidity by offering competitive bid-ask spreads and deep order books.

Top Crypto Liquidity Providers

3. Provider A

Provider A is a leading crypto liquidity provider known for its robust services and advanced integration options. Some of the key features and services provided by Provider A include:

– Comprehensive market data and analytics

– High-speed order execution

– Customizable liquidity pools

– Support for various cryptocurrencies

Integration options with Provider A are flexible, allowing traders to seamlessly integrate their trading platforms. By partnering with Provider A, traders benefit from improved trading execution, reduced slippage, and access to a wide range of trading pairs.

4. Provider B

Provider B is another prominent player in the crypto liquidity provider space. It offers a suite of services tailored to the needs of traders. Key features and services provided by Provider B include:

– Deep liquidity pools

– Advanced trading algorithms

– Risk management tools

– Real-time market monitoring

Integration options with Provider B are user-friendly and efficient, enabling traders to leverage their liquidity seamlessly. Traders partnering with Provider B gain access to enhanced market efficiency, reduced trading costs, and increased liquidity.

5. Provider C

Provider C is renowned for its cutting-edge technology and comprehensive liquidity solutions. Some of the features and services offered by Provider C include:

– Robust API connectivity

– Aggregated liquidity from multiple sources

– Smart order routing

– Advanced risk management tools

Integration with Provider C is highly customizable, allowing traders to tailor the liquidity solutions to their specific requirements. By partnering with Provider C, traders benefit from improved trading execution, enhanced liquidity, and reduced counterparty risk.

Factors to Consider When Choosing a Crypto Liquidity Provider

6. Reputation and Reliability

When selecting a liquidity provider, it’s crucial to consider their reputation and reliability. Look for providers with a proven track record in the industry and positive feedback from traders.

7. Depth of Liquidity

Ensure that the liquidity provider offers deep pools of liquidity across various cryptocurrencies. This ensures that you can execute trades quickly and at competitive prices.

8. Technology and Connectivity

Evaluate the technology infrastructure and connectivity options provided by the liquidity provider. Seamless integration with your trading platform is essential for efficient trading.

9. Pricing Structure

Consider the pricing structure offered by the liquidity provider. Look for transparent and competitive pricing, avoiding hidden fees or unfavorable terms.

10. Security Measures

Security is of utmost importance in the crypto market. Choose a liquidity provider that prioritizes security measures such as encryption, two-factor authentication, and cold storage for funds.

How Crypto Liquidity Providers Empower Digital Asset Trading

11. Enhanced Market Efficiency

Crypto liquidity providers enhance market efficiency by providing a constant stream of liquidity, reducing the impact of large orders on prices, and minimizing bid-ask spreads.

12. Increased Liquidity

By aggregating liquidity from multiple sources, crypto liquidity providers ensure a deep pool of liquidity, allowing traders to execute large orders without significant price slippage.

13. Reduced Slippage

Liquidity providers minimize slippage by offering tight bid-ask spreads and ample liquidity, ensuring that traders can buy or sell assets at the desired prices.

14. Improved Trading Execution

With the support of liquidity providers, traders can execute trades quickly and efficiently, benefiting from faster order matching and improved order execution.

The Role of Liquidity Providers in Creating Forex Brokerage Platforms

15. Importance of Liquidity in Forex Trading

Liquidity is vital in the forex market as it ensures that traders can enter and exit positions at any time with minimal price impact. Crypto liquidity providers offer access to deep liquidity pools, enabling forex brokerages to provide better trading conditions to their clients.

16. Benefits of Crypto Liquidity Providers for Forex Brokerages

By partnering with crypto liquidity providers, forex brokerages can access competitive bid-ask spreads, deep liquidity, and improved order execution. This allows them to attract more traders, enhance their offerings, and increase trading volumes.

Conclusion

Top crypto liquidity providers play a pivotal role in empowering digital asset trading by ensuring market efficiency, increasing liquidity, reducing slippage, and improving trading execution. Their services are crucial for traders looking to navigate the fast-paced and volatile world of cryptocurrencies. Moreover, liquidity providers also contribute significantly to the creation of forex brokerage platforms, enabling brokers to offer better trading conditions and attract a wider client base.

FAQs

1. What is the difference between a liquidity provider and a market maker?

A liquidity provider connects buyers and sellers in financial markets, while a market maker quotes both bid and ask prices and is obligated to buy or sell at those prices.

2. Can I use multiple liquidity providers simultaneously?

Yes, it is possible to use multiple liquidity providers simultaneously. This allows traders to access a broader pool of liquidity and benefit from competitive pricing.

3. How do liquidity providers make money?

Liquidity providers typically earn money through the bid-ask spread or by charging commissions on trades executed through their platforms.

4. Are crypto liquidity providers regulated?

Regulations surrounding crypto liquidity providers vary across jurisdictions. It’s important to choose reputable providers that adhere to relevant regulations and compliance standards.

5. How can I integrate a liquidity provider into my trading platform?

Integrating a liquidity provider into your trading platform typically involves utilizing their APIs or connecting through a trading platform that supports integration. Contact the liquidity provider for specific integration instructions.

Recent News

Sweet Escapades: Europe’s Legendary Desserts

Europe is a continent rich in culinary traditions, each country offering its own unique flavours and gastronomic delights. Among the...

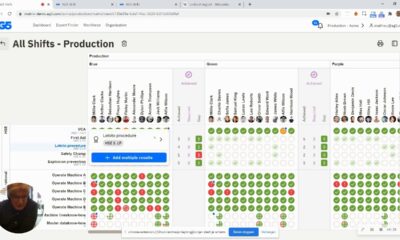

Managing Your Career Using AG5’s Skills Matrix Navigation System

Skills matrix navigation system is a comprehensive framework by AG5 that helps individuals assess, track and develop their skills in...

Top Tips for Finding the Best Spearfishing Charters in Key West

Finding the right spearfishing charter in Key West can be a game-changer for your next adventure. Whether you’re a seasoned...

Simplifying Shopping with Multi-Option Gift Cards

The holidays are filled with joy, laughter and warmth but also a time when we have to find the right...

4 Days in Crete: A Quick Guide to the Island’s Highlights

The largest and most populous of the Greek islands, Crete is a captivating destination that offers something for every traveller....

4 Ideas To Make Your Baby Shower Pop

Nothing compares to the joy and anticipation of bringing a new baby into the world. A baby shower is the...

AI Content Detector: Ensuring Quality and Authenticity in Digital Writing

In the digital age, where content creation is at its peak, the need for tools that ensure quality and authenticity...

FamiSafe vs. Other Apps: Tracking Cell Phone Locations

FamiSafe is a comprehensive parental control app designed to monitor, manage, and protect children’s online activities and real-world whereabouts. It...

Factors to Consider When Choosing Building Cleaning Services in Dubai

In a bustling metropolis like Dubai, where the skyline is dominated by impressive skyscrapers and architectural marvels, maintaining the pristine...

Leading Exhibition Stands Contractor in Dubai: Setting the Standard for Excellence

Dubai, the dynamic and cosmopolitan hub of the Middle East, is a global hotspot for exhibitions and trade shows. With...